Banks require their customers to preserve a certain month-to-month or quarterly common deposit of their savings bank debts. Savings account holders must keep monthly average stability – which is common of daily final balances in a financial institution account – to the tune of Rs. 1,000-10,000 in PSU lender State Bank of India, and its private quarter friends HDFC Bank and ICICI Bank. Failing to comply with the month-to-month average balance or MAB guidelines – or minimal stability policies – set by the banks attracts penalty prices relevant to the consumer.

Failing to conform with the required minimum balance rules attracts penalty fees in the variety of Rs. 5-600. The minimum stability requirement and the penalty expenses range from the place of financial institution branch and diploma of a shortfall in the account balance.

Here’s an assessment of the minimal common stability requirements relevant to financial savings bank bills in SBI, HDFC Bank, and ICICI Bank:

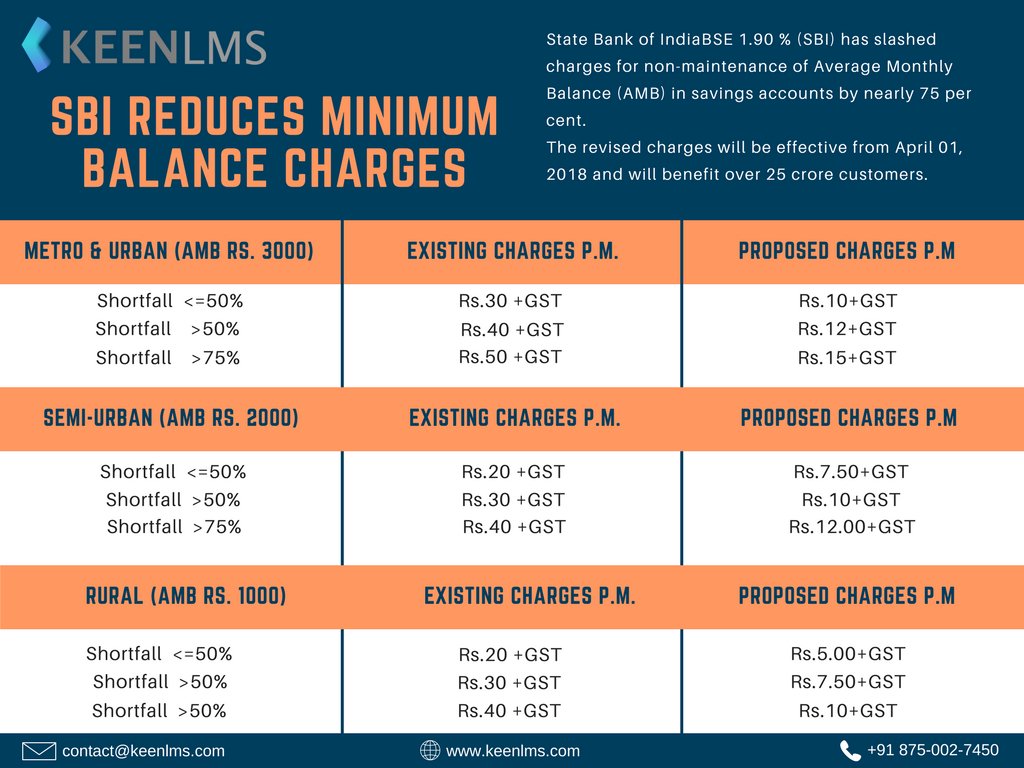

SBI

Individuals protecting everyday financial savings financial institution bills in SBI branches placed in metro and concrete areas are required to preserve a month-to-month average balance of Rs. Three,000, consistent with the bank’s website – sbi. Co.In. Those retaining SBI financial savings accounts in semi-city and rural branches are required to keep minimal common stability of Rs. 2,000 and Rs. 1,000, respectively.

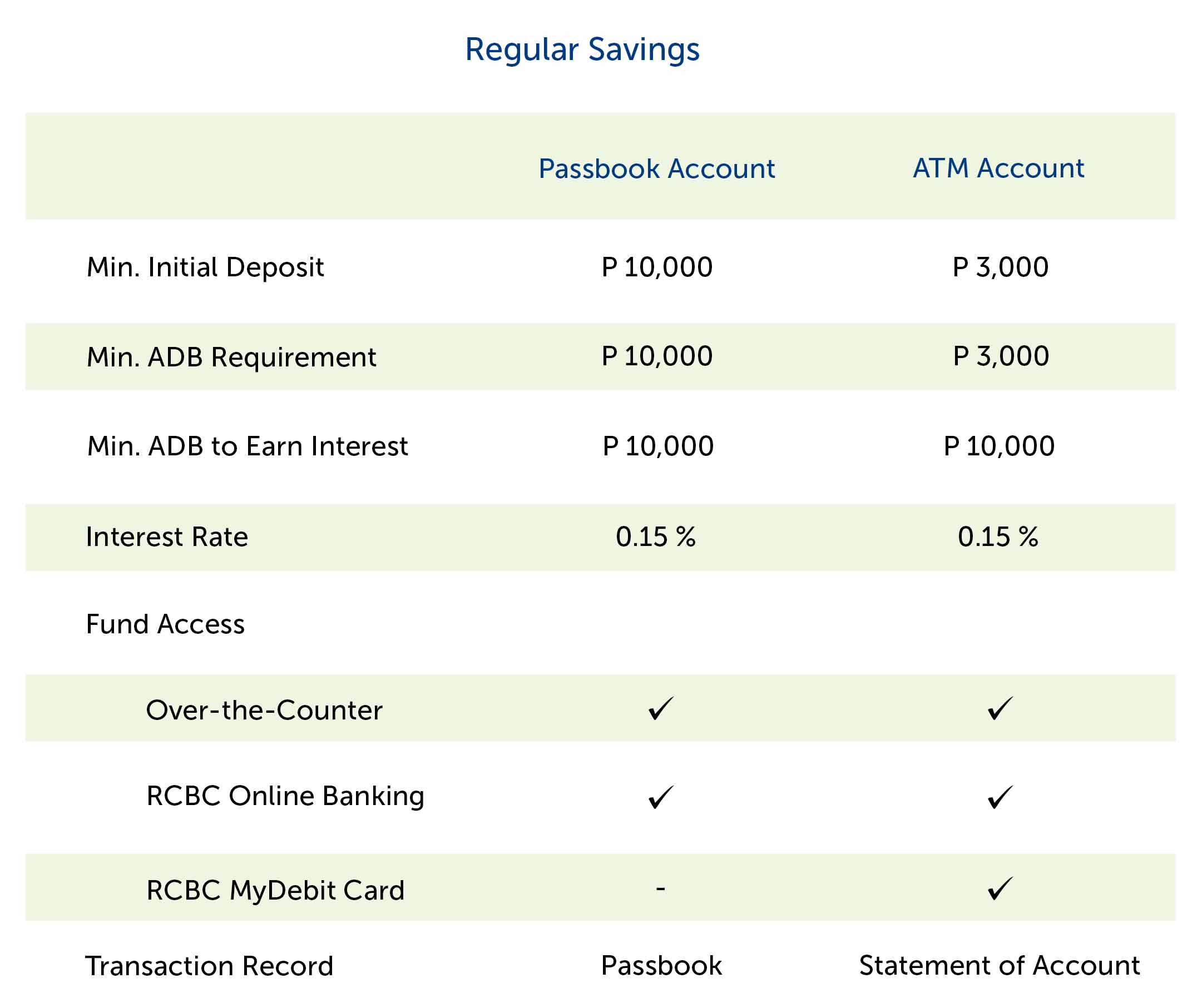

Those preserving regular financial savings account in HDFC Bank branches positioned in metro and concrete areas must hold a mean monthly balance of Rs. 10,000, according to the bank’s internet site – hdfcbank.Com. In semi-city branches, the everyday financial savings account holders are required to maintain mean stability of Rs. 5,000 each month. In rural branches, the customers must either keep a mean quarterly balance (ABQ) of Rs. 2,500 or installation a set deposit of Rs. 10,000 for a adulthood duration of a minimum of 12 months and sooner or later, according to the financial institution.

How to Transfer Your SBI Savings Account From One Branch to Another Online

If you’ve got financial savings to account with the State Bank of India (SBI) and want to switch it to each other branch, you may accomplish that online inside every week, and that too with no expenses involved. You do not even need to go to your bank branch to perform formalities as through the net, you can perform all formalities from everywhere in India.

If you want to switch your SBI monetary savings account to a one-of-a-type branch, underneath, we’ve listed the process on the way to do it online. But earlier than that, allow’s apprehend a few stipulations that should be fulfilled to transfer your account to every other branch properly.

Things to understand in advance then you begin with the transfer gadget

Below is the list of factors that you should understand before you still transfer your SBI economic, financial savings account online:

• The option to transfer your SBI financial institution account online is great for monetary savings money owed.

• The SBI payments, which can be inoperative or KYC (apprehend-your-customer) poor, do now not qualify for this facility.

• Another crucial prerequisite initially the SBI financial savings account switch online approach is that the account holder’s cell range must be registered with the economic organization.

• The account holder ought to moreover have the get proper entry to the SBI Net Banking facility.

• Before beginning the account transfer approach online, be geared up with the department code to which you need to interchange the SBI savings account.

• You may additionally even name SBI client care to get the data.

The process to Transfer SBI Savings Account to every different Branch Online

• Go to http://www.Onlinesbi.Com.

• Select ‘Personal Banking.

• Login in your Net Banking account together with your username and password.

• On the top panel, pick out the ‘offerings’ tab.

• Select ‘Transfer of financial savings account.’‘

You’ll be directed to each different web page to show your account information, including bank account quantity and bank branch name. It will show all your SBI financial savings money owed (when you have a couple of).

• Select the savings account that your choose to transfer to a few different departments.

• Enter the department code wherein you desire to exchange your account.

• Verify the account transfer records using every existing and new branch code.

• Click on the ‘Confirm’ button.

• An OTP might be generated and sent on your registered cellular range.

• Enter the OTP acquired for your mobile number

• Click on the ‘Confirm’ button.

The gadget completes with a message, ‘Your branch transfer request has been efficiently registered.’

Note:

• If you have got quality one account or want to switch all your debts from one branch to another, the CIF (Customer Information File) has to be usually transferred to the new department. Your CIF consists of information of all of your financial institution money owed.

Before the account switch, if you have given your financial institution the IFSC code to different financial institutions such as mutual finances or the Income Tax Department, you’ll need to update them of the new code as soon as it has been changed. • After the procedure, your account variety, and CIF will stay the same; however, your financial organization’s IFSC code will trade as it’s far branch specific. It is critical to tell the concerned monetary establishments approximately the department code trade to revise their present ECS and one-of-a-kind fame commands.

• Transfer an SBI economic savings account from one branch to each different may also take weeks. Once the switch has been completed, you will be able to see today’s branch call after stepping into your Net Banking account.